Kent’s Quarterly Economic Survey Q4 2021: Recovery Weakening As Inflation Worries Soar

Kent’s largest independent survey of business sentiment – has shown the recovery stalled in the fourth quarter, with firms facing unprecedented inflationary pressures. The record-high levels of concern amongst businesses around inflation has been the most pressing issue carried forward from the last quarter, with a rise in price pressure and concern about interest rates.

This quarter’s highlights are given below:

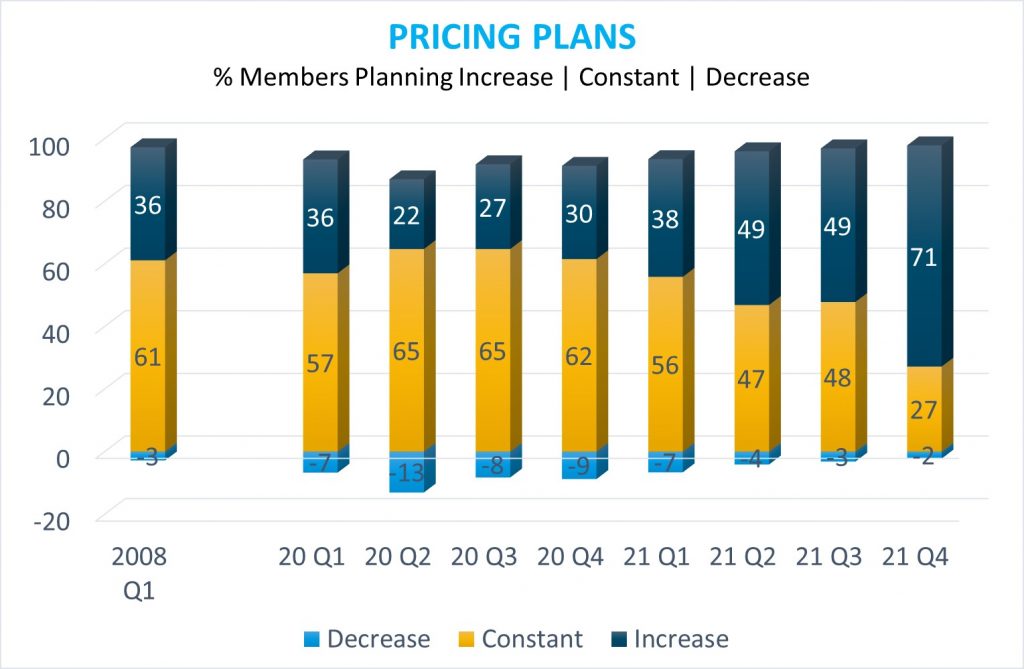

- 71% of firms expect their prices to increase in the next three months, the highest on record. 67% of businesses cited inflation as a concern, also a record high

- 1 in 8 firms were worried about rising interest rates, as concerns over rate hikes among manufacturers reach record high

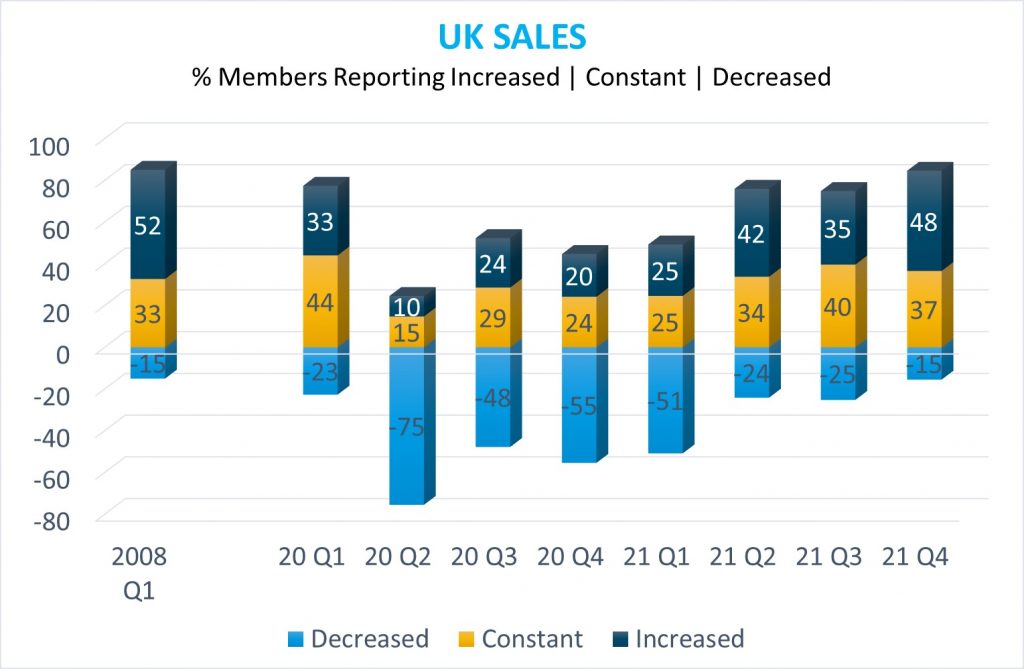

- Just under half of firms, 48% reported increased domestic sales in Q4, compared to 35% in Q3

The survey showed some indicators revealed a continued stagnation in the proportion of firms reporting improved cash flow and increased investment. Inflation is the top issue for firms, while a rise in the interest rate was also a cause for concern for many.

Business activity

48% of respondents overall reported increased domestic sales in Q4, up from 35% in Q3.

Prior to the surge in Omicron infections, hotels and catering had been most likely to report increased domestic sales. This represented the beginning of a potential recovery as the sector was also the most likely to report decreased sales throughout the rest of the pandemic. The majority reported decreased sales and cash flow at the start of the pandemic in Q2 2020. Worryingly, a similar decline is now possible in the face of the Omicron variant and the implementation of Plan B which led to new restrictions for some.

Unprecedented Inflationary Pressures

71% of firms expect their prices to increase in the next three months, the highest on record. A jump of 20% from Q3. Only 2% expected a decrease, the lowest ever recorded (See below).

The percentage expecting an increase rises dramatically to 71% for firms. These are the highest on record.

When asked whether firms were facing pressures to raise prices from the following factors, 51% of firms cited raw materials, 54% cited other overheads, 22% cited pay settlements, and 15% cited finance costs.

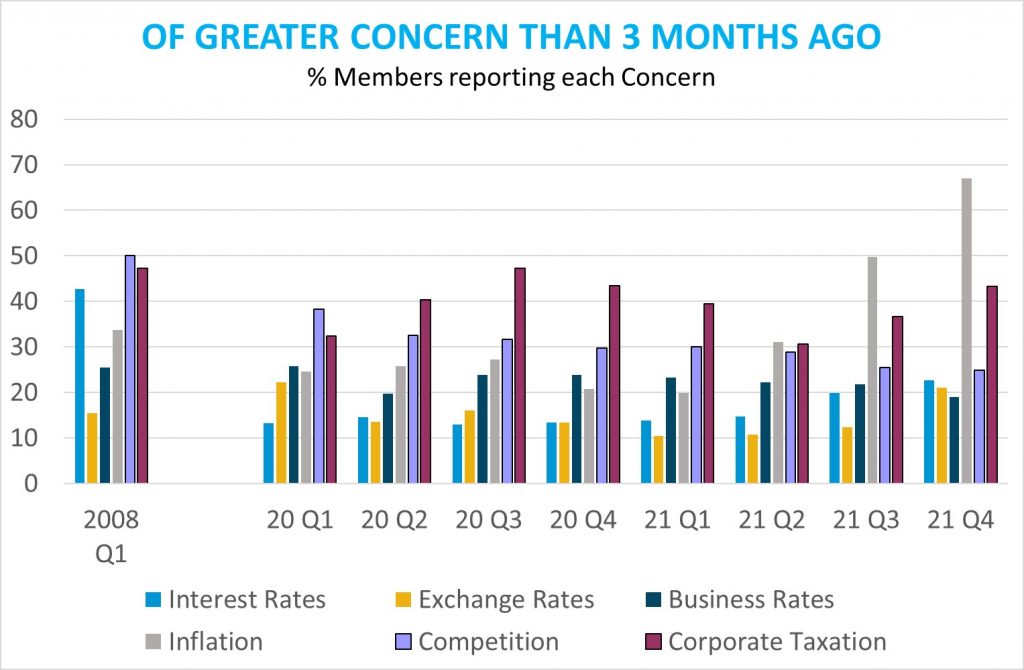

When asked what was more of a concern to their business than three months ago, 67% of firms overall cited inflation (compared to 50% in Q3 2021 and 21% in Q4 2020), the highest on record. For production and manufacturing firms, this rises even more significantly (Can be seen below).

Concerns over higher interest rates rise sharply

The percentage citing interest rates as concern rose in the quarter. 1 in 8 firms (23%) reported interest rates as a concern, up from 20% in Q3 (Can be seen in the image above). The percentage mentioning interest rates as worry in Q4, the highest seen since the metric was first collected.

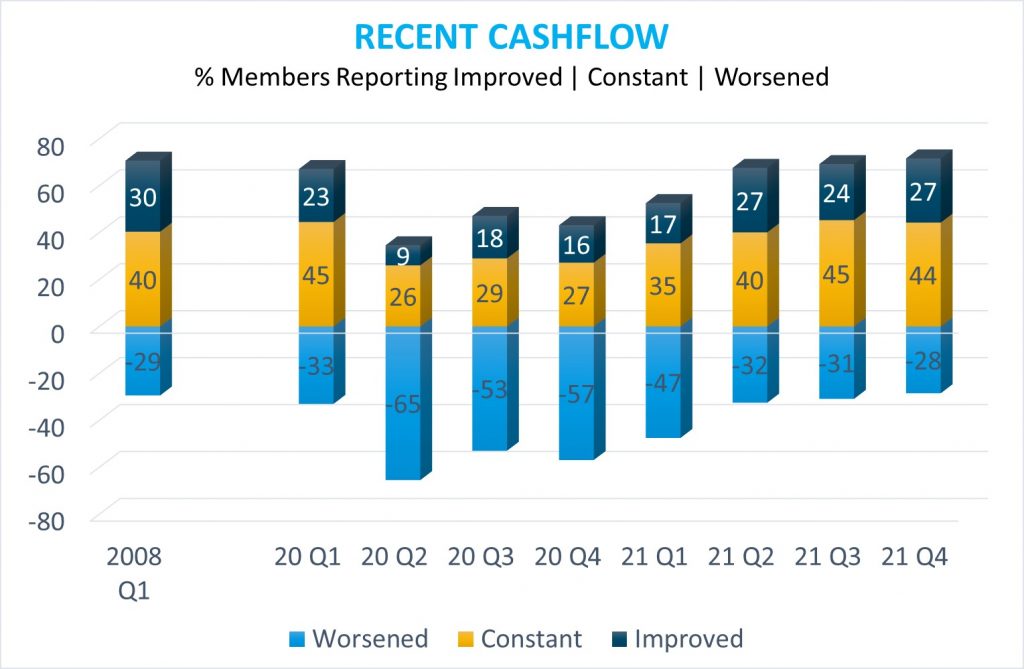

Little recovery to Cash Flow

For firms overall, 27% reported an increase in cash flow, while 44% reported no change and 28% reported a decrease (Can be seen below).

Given these figures were reported before the full impact of Omicron and the introduction of Plan B, this metric is a cause for concern, as some firms are still struggling to recover from large-scale losses incurred since the start of the pandemic.

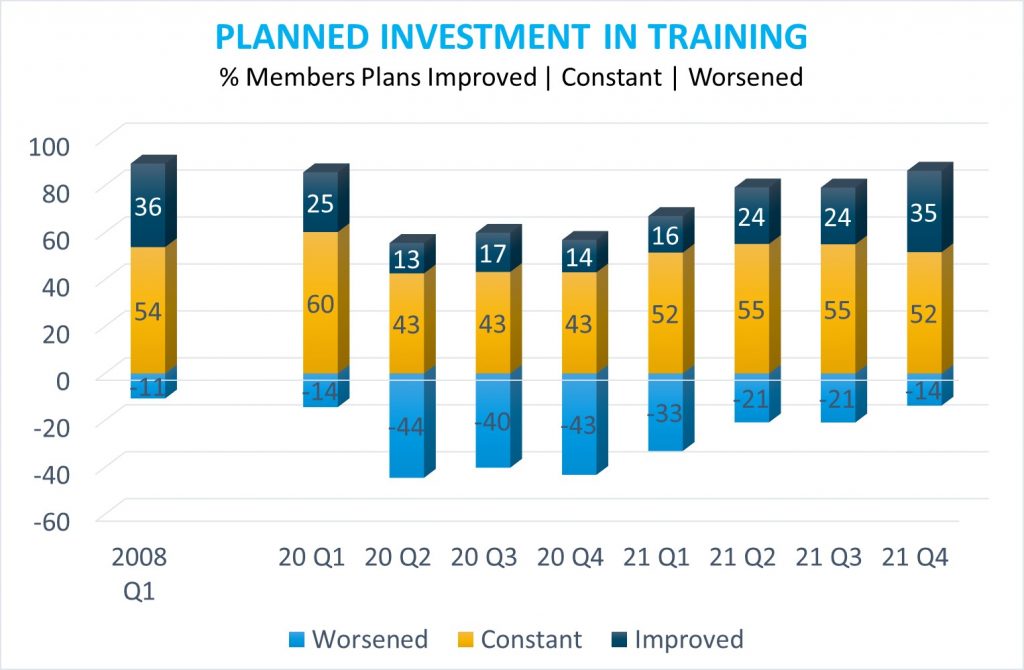

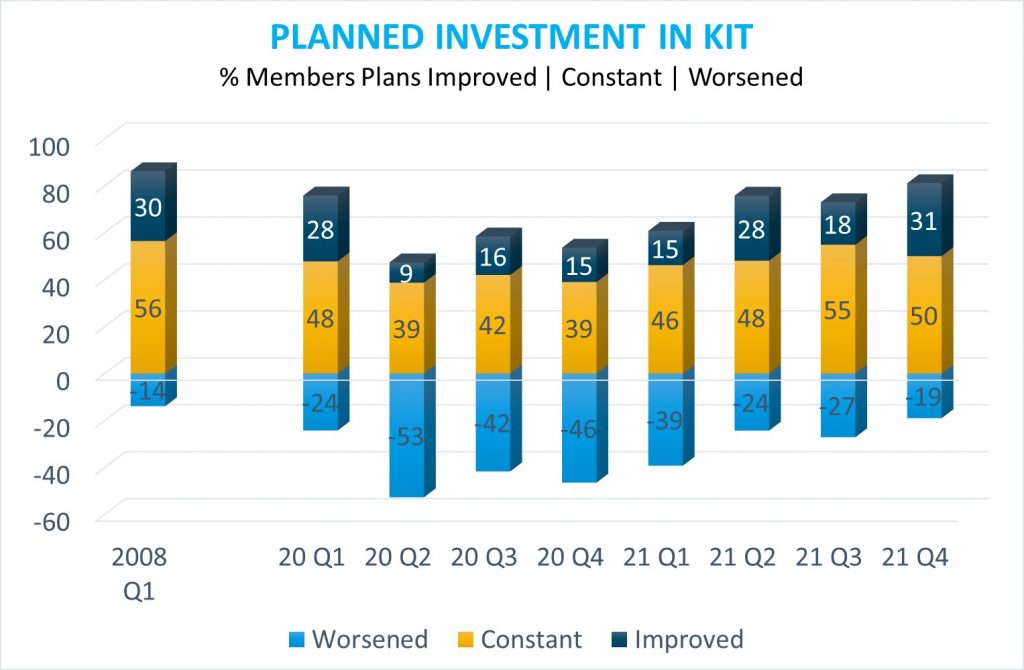

Most firms still not investing

Investment in plant, machinery, or equipment increased a bit in Q4, with 31% overall reported an increase, while 50% reported no change, and 19% a decline (Can be seen below).

Keep in mind these were stats collected before the Omicron hit, so not a completely accurate representation.

Suren Thiru, Head of Economics at the British Chambers of Commerce (BCC), said:

“The notable uptick in concerns over higher interest rates underscores the need for the Bank of England to proceed with caution on further rate rises to avoid undermining confidence and an already fragile recovery.”

“Rising inflation is likely to weaken the UK’s growth prospects this year by eroding consumers’ spending power and squeezing firms’ profit margins and ability to invest.”

Responding to the findings, Director General of the British Chambers of Commerce, Shevaun Haviland, said:

“The Government has listened to our previous calls for support, and it must do all it can to steady the ship and steer the economy through these uncertain times. If the current restrictions persist or are tightened further then a more comprehensive support package that matches the scale of any new measures, will need to be put in place.”

“The focus must be on creating the best possible environment for businesses to grow and thrive. By supporting firms, they can begin to generate wealth, create jobs and support communities.”

Below you can see comments from the local businesses which reflects the same:

“Raw materials have doubled, freight has increased, minimum wage is up, prices are having to be increased to survive, inflation is coming.”

Mid-size manufacturer in Kent

“Our gas and electric is increasing by 250% because we run a laundry this is a massive impact. This is due to the collapse of the smaller suppliers.”